House Prices - Bound for a Fall in 2023?

House Prices - Bound for a Fall in 2023?

Every single forecaster is lining up to give the UK property market a kicking, the market has run away with itself since the pandemic and is at unsustainable levels in respect to income being the logic. On top of that, interest rates have climbed so rapidly since September that getting the numbers to stack up now as a purchaser means one thing - prices must come down.

Pundits predict the drop in the range 10-20% next year, even the sober Office for Budget Responsibility (OBR) weigh in with a 9% drop over the next 18 months. When you consider the OBR also forecast around 12% inflation over that 18 month period, in real terms they are in effect predicting a fall on the 2008 Global Financal Crisis scale. Does that sort of drop feel right to you? Let's look at the key drivers which are likely to move the market in the coming year to make some sense of it.

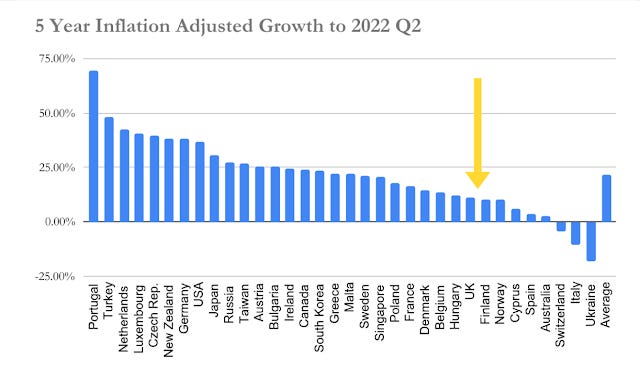

International Comparison

First, a look at how the UK market has performed on a global stage. Despite the media frenzy about how affordable the market is, the UK is a true laggard when measured over the last 5 years across the world and shows we have not got too far "over our skis" as compared to some other countries.

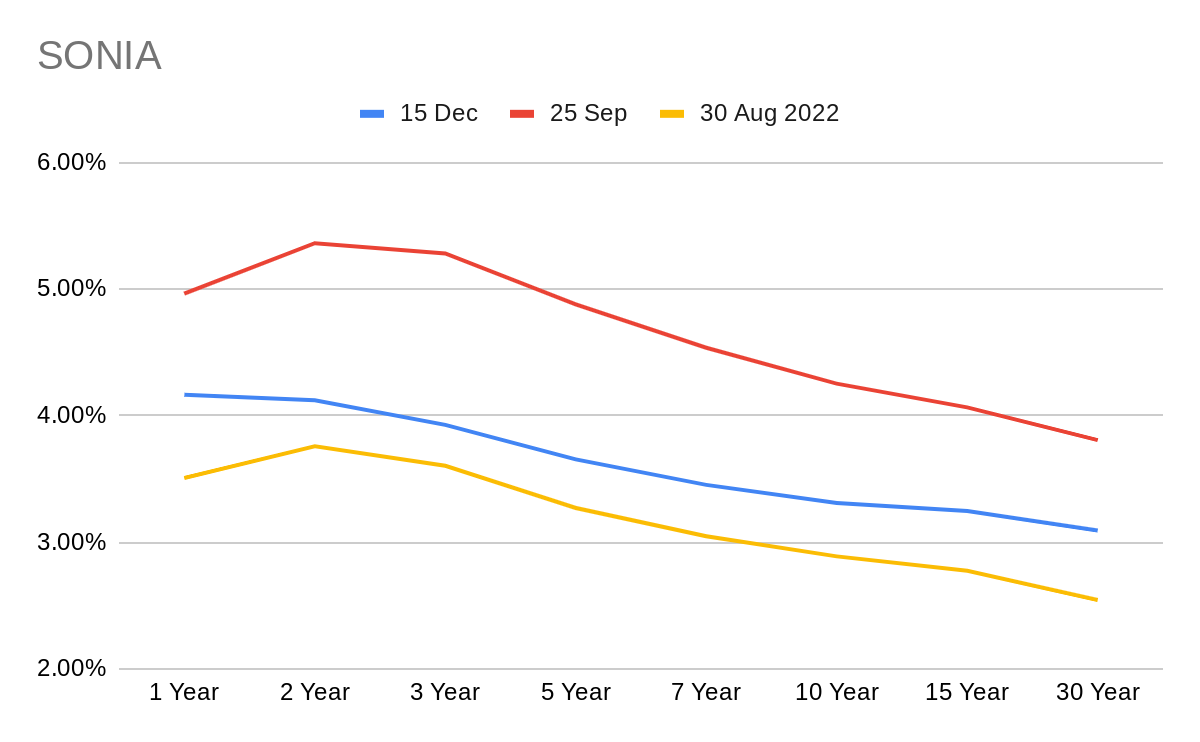

Interest Rates

The graph above shows the SONIA rate, this forms the basis for pricing of residential mortgages in the UK. New mortgage fix rates offered are taken off the corresponding year on the horizontal axis. The 3 lines here are in yellow the level at the end of the summer, in red just after the Liz Truss Mini Budget and in Blue on 15 Dec. Clearly the rate shot up just after the budget but the line now is back very close to that at the end of the summer, just 0.4% or so above at the 5 year rate for example. However, 5 year BTL fix rates at the end of the summer were around 3-4% and they are now 5.5-6.5%, a huge gap. Why is this if their SONIA plots are so close? It is all down to stability. Rates need to find a certain stable level for banks to get confidence to slim their margin above the so-called "risk free" SONIA level. Additionally, stable rates will lead to a growth in competition between banks on rate levels, driving them down further towards the SONIA line.

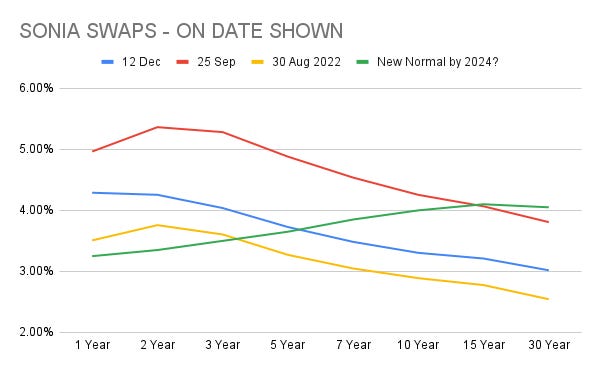

This graph above shows the same SONIA rates but now with a green line showing my best guess for where the curve could be in around 12 months, based on current data and forward-looking indicators (mainly involving tea leaves). A few things are of note here on the green plot. Firstly, whilst the other plots invert in their slope around the 2-5 year point, the green line slopes gently upwards. The slope of the green line is what is usually seen, the other curves indicate a so-called "inverted yield" and indicate markets pricing in an imminent slowdown or recession. The green plot also starts at the shorter term end of 1 year at a lower level. This indicates that central bank rate has stabilised, in this case a rate of approx 3% bank rate is assumed (at time of writing the rate is 3.5%). Should 2023 play out as above and a plot similar to the green curve become established then new BTL mortgage fixed rates should fall from the current 5.5%-6.5% level down to the 3.75-4.75% level ie near that offered at the end of the summer of 2022.

Wages

Wage growth is a key driver in both the tenant and owner-occupier markets. Rents tend to follow wages over the long term and on the purchase side borrowers are typically given a multiple (4.5X being typical multiple on a single or joint income application). Since the onset of the pandemic in March 20, UK average wages have increased by 17% and have been increasing in pace throughout this period. It is likely, with high prevailing inflation and workers looking to make up lost ground, wage increases should continue at a high level of the coming 1-3 years so this will offer support to both rent and house price levels.

Rents

We said above that rents tend to follow wage increases and when looking at existing rent levels this is the case to a close regard. However, looking at just newly-created tenancies over the last 5 years using regional data from Rightmove we see that rents outside of London have increased dramatically. This has the effect of supporting prices for property bought as an investment and also in driving motivation for long-term renters to buy as this can be cheaper.

Property-type Comparisons

Whilst there is a commonly-held view that UK property has been flying up since the pandemic, when looking at different property types the case is not so clear. Historically, houses and flat prices increase at roughly the same level and this was the case as we can see from the graph above from 2018-20. The fortunes of each property type then really diverged as space and access to countryside became prized. Recent months show that the return to the city centre has started to close this gap and a mean reversion (ie flats catch up) should logically occur over the coming year.

Sentiment

Sentiment is the most difficult to chart or predict, but as far as the property market is concerned it is perhaps the most important factor. This is what makes a forecast over just one year a finger in the air, but its fun so let's keep going. Unlike other economic forces, sentiment can come and go in the blink of an eye - just look at the effect of the mini-budget within days of its announcement.

So what can be said of any use on this driver? Well, sentiment is so low at the moment that anything that comes next year must surely be to the upside. The biggest injection to optimism of course would be a resolution to the war in Ukraine, we can all hope for that for the sake of that country. Short of that, a taming of inflation should help central banks ease up on interest rate policy and investor sentiment will slowly improve from the levels of today..

Conclusion - Making a Positive Case for Next 12 Months

As we end 2022, the market is currently weighed-down by low sentiment due to the high cost of living and also recent interest rate increases. If these two factors persist into 2023, then you can certainly see many parts of the market (perhaps with the exception of city-centre flats which have performed poorly over the pandemic) dropping in the range of 10% next year in line with the common view of the pundits. But I argue here that this is not how things will play out in 2023.

Looking forward to the spring, there are so many things which could surprise to the upside. Firstly inflation should start to fall rapidly once the base costs of 12 months ago when the war in Ukraine started were baked in. The key components which pushed inflation in the first place, oil & gas prices and shipping costs are already lower than 12 months ago. For the UK, inflation was also pushed higher by a weak pound sterling and this has already bounced back to March 20 levels. This should all give the Bank of England plenty of justification to halt rate rises and even perform a sharp U-turn if the recession looks severe. As the SONIA yield curve flattens as the slowdown or recession is digested by the market, the margins on rates set by lenders should also get much thinner. Buy-To-Let 5 year fixes now at 5.8% could easily come down to a far more manageable 4.5%, owner-occupier 5 year products may even get down to 3.75% or so. These rates will start to be seen as cheap by purchasers after the shock of 2022 Q4 and improve buyer confidence. Perhaps it will even dawn on investors that the real interest rates, ie after inflation is costed, are more negative than ever. `

We should then see a stabilisation of the market in Q2-3, with the continued return to the city centres which have been stagnant for many years should feel some heat and start to tick up. This will help with the stock of buildings blighted by the cladding crisis increasingly being mortgageable and hence open to more buyers.

We cannot forget though that the market is already elevated and values do not have too far to go now, but the wage increases of 6-7% pa since 2021 should continue and this should prop up lending multiples to allow the market to march on for one last heave upwards. It does not feel like boom time ahead but equally it certainly does not feel like the end of days for the market as it did in 2008 and as many are predicting now.

You Said it Was a Conclusion

Enough waffle, my prediction? By the end of 2023, the UK market as a whole should be slightly up in nominal terms (1-2%) but of course this is a fall in real terms as inflation will outpace this nominal increase. Variations on this will occur across the regions of course and some city centres could put on 5-10% whilst some more rural or suburban areas which have been hot lately in the "race for space" drop back a little by the same amount. For an investor with dry powder, 2023 should prove a great one for acquisitions whilst investors looking to offload will find it more difficult. Shame I am in the latter camp, 2024 & 2025 should hopefully be vintage years for sales. Or I need to rethink my retirement plot.....