Portfolio Update

We published the first detailed overview of our own investment portfolio in Nov 24, it is here. The idea was to share details of our portfolio to highlight our biases in terms of what we hold and also as we near retirement share any tips, disasters and general lessons we have learned along the way. We previously outlined just the details of the portfolio and we then promised a deeper dive into each aspect to reveal what’s been going on ‘under the hood’ to get us to where we are at now. In this update we will focus on just the property aspect of the portfolio, by far the lion’s share of the portfolio currently but likely to decrease in the coming years. We will draw 3 key lessons learnt from our property investment journey thus far using actual performance data from our portfolio.

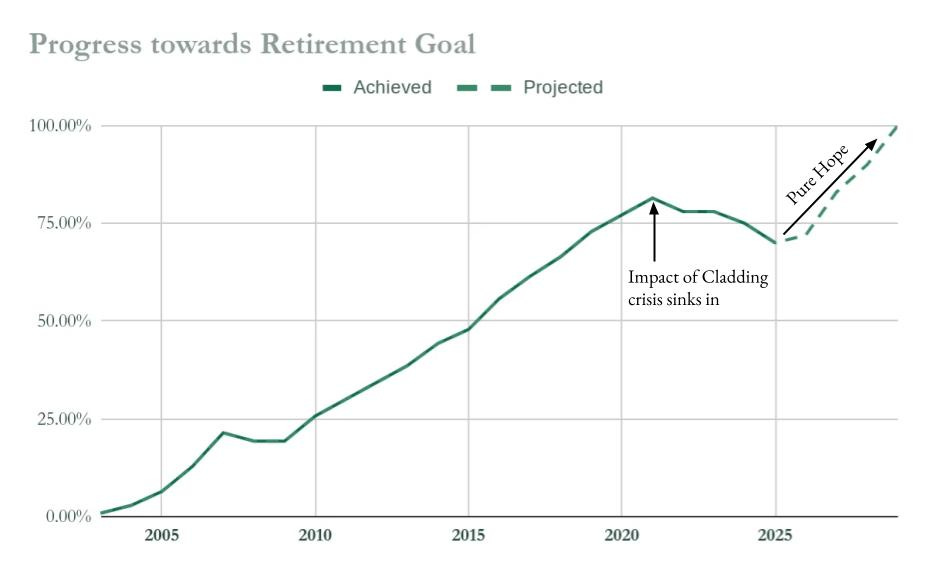

Quickly before we do that, a measure of our overall goal towards retirement. This is our progress towards our target net asset value which will see us through retirement. As the graph shows below, we had a fairly linear growth in our net asset value after the recovery from the GFC in 2007 up until 2020 when we hit 83% of our target. As the property market started to really heat up in mid 2020 we were sure to continue on at least trend growth and be able to retire fully by 2023. A big reveal, we are still way off retirement so what happened? Since late 2020 we have seen a 12 % fall in net asset value and has fallen to 71% of our target by Feb ‘25. This was due to a 4 year continued down valuation of the property portfolio. This brings us to Lesson #1.

Lesson #1 - Diversification (A Failure)

Let me put our fall in net asset value in perspective as a 12% reduction does not seem catastrophic - it is in fact a fall back even bigger than we suffered in 2007. Remember this fall took place from 2020-24, a time when UK property values on average have increased by around 25%. Add to that, our self-invested pensions were only opened in 2020 and they now represent 12% of our net asset value. If we just had the average UK property in our portfolio, we would in fact be well in excess of our retirement target by now. We made a huge mistake, I share it here so you do not do the same.

The fall in our net asset value was due solely to a 22% fall just in property element of the portfolio. How did we make this huge mistake? Put simply, our focus was entirely on city-centre rentals mainly in the midlands and north with a complete disregard to diversify into other property types such as suburban houses. This gave us a huge exposure to anything which would hit the city centres, a seemingly unlikely prospect but enter stage left a pair of black swans - the cladding crisis and a pandemic. These two events pushed demand outside city centres, sales for units like ours stuffed with high-rise leasehold fell like a stone from 2020.

Here’s our property portfolio in a little more detail with respect to cladding:

The above chart shoes how our own portfolio has been affected by the crisis following the Grenfell Tragedy. Any city centre investor will have a similar breakdown, unless they operate within cities like Edinburgh or Bath where lower-rise period stock is more common and unaffected. As we had not diversified, we found ourselves hugely affected and 72% of our units had potential cladding issues. The full impact only started to become clear in 2020 as banks withdrew new funding from these units but with sales volumes very low, it was difficult to determine the extent of the issue until more recently. We use the mark-to-market technique of valuing our portfolio each month and for the cladding units the few sales that have gone through have been at levels back down to near where we initially purchased around 2012-2016. As an example, here is the price history of a 2 bed apartment in Leeds affected still be cladding problems (not one of ours):

The above shows how the pricing of apartments with cladding issues have developed in many UK city centres during this cycle. After the peak in prices in 2007, they fell to a low point around 2012-15 and actually staged a recovery for a time. The unit above would have made around £190,000 in 2019 with a good wind. Since then, the cladding crisis has removed value even where buildings have the EWS1 safety certificate such is the lack of confidence for city centre buyers of leasehold flats in general. On top of this, a steady flow of repossessions have been coming to the market recently presumably from buyers who are hit when it comes to refinancing at today’s higher rates and have decided to throw the towel in. These type of sales do not always get recorded on the Land Register but tracking data from auctions in the last quarter has shown that prices really have been hit and we have had to mark our portfolio down accordingly.

[Note: we are exploring new ways to regularly value our portfolio in an easy and more accurate way using applications which use AI - I report back on a future post].

The hope is, as cladding remediation gains steam along with a returning appetite for city living as well as reform of the leasehold system, progress on our retirement goal in line with the previous gradient from 2009-2020 returns and we reach our 100% target by around 2029. Indeed, we have been doubling down and purchasing units affected by cladding at the current reduced prices in a bid to accelerate our route to retirement. To many this will sound bonkers, why increase our pain? I suppose it is the same as buying into shares which you own after a fall and covering your loss. Said like a true gambler, time will tell if this bet pays off.

So, even though apartments have been our core business over our whole journey and have performed better than other property types up until 2020, investing in other property types would have delivered a more reliable outcome.

So our lesson for portfolio building is to apply a more diverse approach to purchasing as a method to protect from any downside risks to a particular property type.

Lesson #2 - Management Strategy

We have tried every possible method of property management over our investment journey. Initially, alongside full-time employment, we opted for full management typically paying 10-15% of the gross rent. We also adopted this approach when investing overseas, even starting up a Letting agent of our own to manage our units in Germany for a time. Around 2011 we then tried a stint of pure-self management where we would communicate with tenants on all issues and instruct contractors to attend where we could not attend ourselves. By getting more hands-on we certainly understood property management better and were able to systemise it to a great extent. We were probably spending on average 3-4 hours a day on management, not so bad, it was just tricky to predict which 3-4 hours as tenant issues were of course unplanned. Around 5 years ago, we made a further change and opted for a blend of both full and self management and it has been the most successful period for management in our journey. What you decide to do will depend very much on your spare time and how many units you have but I will lay out the details of each approach so you can decide what fits to you.

Looking at the scale of the issue, below is a pie-chart showing what element of the gross rent can be spent on management. I have used data from across our 40-odd units which were on long let in the previous tax year:

Looking to the chart above, it shows that the profit before management cost is 29.2% of the total gross rent for our portfolio. That is to say, for a unit which has a rent of £1,000 per month we are likely to see a profit before management and tax of around £290. This is the average based on our leveraged city-centre portfolio, yours may look a little different but likely in the same ball-park. How we choose to manage the properties and tenants will then reduce this profit to a greater or lesser extent.

For full-on self management, you get to keep all of this roughly 29% less any costs like petrol, transport and tools and other costs needed to keep the show on the road. You will clearly need time and the head space to deal with tenant and property issues, doing this alongside a full-time job will be tricky once you have more than a handful of units.

On the other end of the scale, a fully-managed model will free up your time but often eat much of this profit such as:

Letting Agent Fee - 10-15% of monthly rent

Letting Agent Extras - 5% for finding new tenants, re-signing contracts and other compliance work.

Letting Agent inefficiency - 5% - they will often not get 3 quotes for maintenance works so jobs not the cheapest. Then they will often put their charge on top of a contractor’s bill. In terms of tenant find, they can leave your property empty for longer and may price your property too low. And so on.

So opting for the hands-off full management can take 20-25% of the 29% profit leaving you with little to show for your investment in terms of cashflow and often you lose control and units go downhill as a result (that’s been my experience anyway).

The blended management approach we now use costs us around 7% of the collected rent and gives a good balance between control of your property, time spent on management and net profit. It is also possible to use this approach alongside a full-time job (or retirement) if set up carefully, let me show you the details of what we do.

Details of a Blended Management Approach

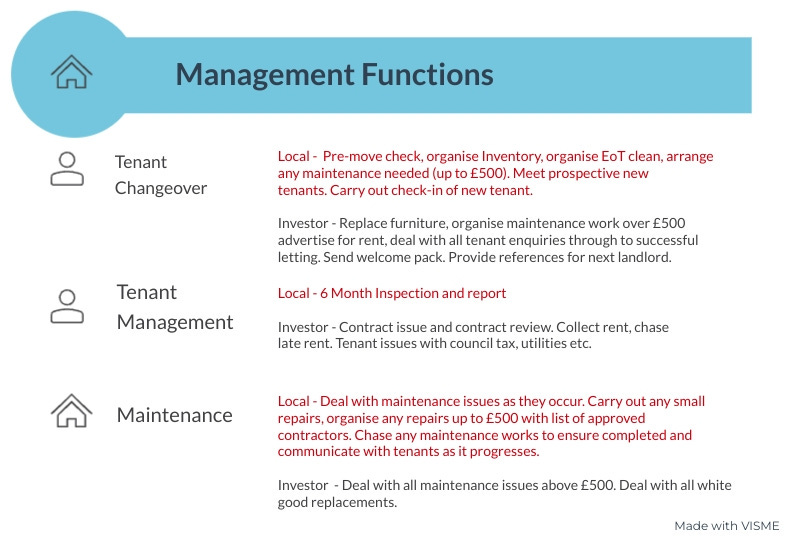

In essence, the blend is between work which can be done remotely and work that requires to be on-site and therefore is outsourced. The below shows the division of labour between the investor and a locally-appointed contractor (in red) across the 3 functional areas of management:

The aim is to get all reactive work such as communication with tenants and work you need to be on the ground delegated and instead just have regular planned meetings with a local contractor to discuss issues and plan non-urgent works etc. Tenants can interact with your local contractor using simple communication via email, telephone and Whatsapp.

The contractor you use on the ground, rather than a dedicated letting agent, is the key point. It just needs to be someone who is competent and attentive, no specific experience needed. In our case, we use cleaning companies as local managers for 90% of our units and for the rest we use contacts introduced through using the viewing service Viewbr. We have also used tradesmen in the past who hold keys and have a big enough team to be able to deal with tenants direct. Have you spotted the huge win-win here? Contrast this approach of paying a non-specialist 7% to a letting agent at say 12%. The agents have offices to run and staff to feed who are often just sitting around staring at a screen. In reality, paying a local person 7% of the gross rent who has none of these overheads will reward them much more. In addition, per hour, the amount of money you will pay say a local cleaning contractor will be 3 to 5 times their usual billable rate. Consequently, set it up right and use the right person and tenants find that they put a maintenance call in and someone is over quicker than you would expect a pizza delivery. Trust me.

The unlock to make this possible was the property lettings site OpenRent which we have been using for 10 years. Before OpenRent, your choices for tenant find were to use a letting agent to get exposure to Rightmove or DIY which meant little notices in newsagent windows etc. The OpenRent platform enables landlords to list direct and get access to all of the portals like Rightmove, Zoopla etc and carry out deposit protection, contract creation etc all for a very low fee (around £50). Once this was possible, the gatekeepers of tenant demand ie letting agents were made redundant for all investors except those with zero time to put to their investments.

One last point, the blended approach still takes up some of our time and this is not a passive investment. For tax purposes, we properly reflect this and bill for this management of our properties within a simple partnership. We did this solely to capture how we operate, but there are some obvious advantages of having profits declared as earned rather than unearned through rent.

I really recommend this blended approach. It takes the “on-call” nature of full management away but keeps you abreast of issues sufficiently to ensure your tenants and properties are always kept to the highest standards and your rents are the highest with minimal voids.

So lesson #2 - unless you have no time at all to dedicate to your portfolio, a blended version of management works well and should be considered once you are established within an investment location.

Lesson 3 - Forget the Monthly Rent and Focus on Capital Values

This one is a longer lesson, skip to the end if you are TLDR and basically agree the f**k out of everything I say anyway.

Long time readers of this blog will be slightly bored of this one, but I am determined to get the drum out and bang it again as it is such an important point that often gets missed. When purchasing an investment, especially at the start of your investment career, it is natural to focus on the rental income and yield. You can measure it, put it on a spreadsheet and start to mentally count your winnings. I know as I fell into this trap and for the first 6 years of our investing, buying just high income properties (I now call them yield-pigs, so you can guess where this is going).

The problem with this approach is twofold. Firstly, in any asset class, higher yield always means higher risk and in property this means risk to collecting rent on time and having your property trashed. This first problem is then compounded as when you invest in higher-yield / lower quality assets not only is rent more unreliable but also capital gains are almost always more muted.

I use our portfolio again to demonstrate this point, here using the average of our last 10 years of tax returns:

This gives a breakdown of the total return of our property portfolio, ie both income and capital, since 2014. Over this time, we have had on average 44 units on long term ASTs and 8 on short term Airbnb. To define each of the totals in the pie chart:

Capital gain is the gain on all property sold, since 2014.

Unrealised capital gain is the growth in value of properties we still hold, since 2014.

Self-Management - The costs of our blended management, roughly half billable to local contractors and half to our own partnership.

Short Lets Net Rent - profits from Airbnb activity.

Long term Lets Net Rent - profits from our ASTs.

Overall then, the return on income and capital for us over the last decade is as follows:

Income = 14.8% + 17.8% + 0.1% = 32.7%

Capital = 37.1% + 30.1% = 67.2%

The eagle-eyed readers will notice we have lost 0.1% from the above total, this was due to rounding of all the categories. The even more eagle-eyed will notice that this rounding error is equal to the net profit from our long lets over the last decade.

Has it sunk in?

Income from properties on a long-let basis make almost nothing. Sure, we have billed from our own partnership for our time in self-managing these assets but that bill is not huge. Without this self-management time, you could of course be doing other work or business activity so that opportunity cost needs recognition.

Is the net income on our ASTs low as we have low income / higher grade properties? Looking at the gross yield on the average long-let unit at current value we are around 7-8%, so fairly standard income in the current market.

Yet still the capital returns have been twice that of income. In a decade of historically low capital growth. Additionally, our income is bolstered by running units as Airbnb’s (time intensive) and doing self management for much of the decade (time intensive). If we had just run the portfolio purely on ASTs using a letting agent, and that letting agent was as efficient as us self-managing, then the return from income would have been 0.1% and from capital 99.9%.

So What?

It all comes down to which units to target when building your portfolio. If we accept that long lets will generally make little or no profit on income but can make very healthy profits from capital when you sell then are you OK with that? Or do you need income to perhaps replace your day job initially? The point here is that it is rare to be able to do both things well in the same property. For example, many investors start out with an income goal to replace their pay from employment. Many will go down the House in Multiple Occupation route (HMO), the trick being to wave a magic wand over, say, a 3-bed terrace and magically come up with a house with 6 letting rooms. Of course, it takes time to wave the magic wand and once rented it takes time to keep the place fully-rented and maintained. But the cashflow can be great, perhaps £1,000 or more net per month. It so simple, 3 or 4 of these and you could replace your wages and give up work. Winner.

However, we need to remember the capital gains as it always trumps income. In terms of capital values, HMOs tend to just get sold to other investors who simply buy off the yield so prices only increase in line with rents. However, increases in interest rates squeeze the returns and capital values can get hit hard as they will have been in the last 2 years. I urge you to look in your areas at the performance of an HMO in terms of capital value versus a regular house just rented on an AST. You will find, from the few re-sales of ready-made HMOs that are out there, that most of the increase in value was created when the property was converted. In an area of good demand, that process of waving a magic wand over a 3 bed semi and turning it into an HMO may deliver say a 30% increase in value once costs are accounted. This is the point at which they should be sold, if there is a ready market for such things in that location. Once you start renting it out, the quality will degrade as will the value of the asset unless rents are really being pushed upwards year on year.

Key Point - Once your income needs are satisfied through employment, business ownership or investment then I would strongly urge any property investment to be analysed using a total return ie net income and capital. By prudently purchasing higher-quality assets, you will increase your gains by working less hard and taking less risk.

And so, we can finally wrap this blog up and capture pretty much the whole of property investing in our final third lesson:

Lesson 3 - Buy yield pigs only when you desperately need the income. Otherwise, buy prime property when no one else is buying and sit back and wait to sell them when everyone is scrambling to buy. Simples.

That’s the main 3 lessons I can draw out of running our portfolio over the last 20-odd years as we near our retirement goal. If we had known all these 3 lessons before we started, we would have retired long ago. You could be charitable and suggest “It’s the journey not the destination”. But we all know that is bullshit and I hope you get to your goals far quicker by not faffing about.