Bonus Blog!

[AI-generated podcast commentary of this blog is here]

It’s the eve of what has been billed as the most brutal Budget we will see in our lifetimes. I am assuming readers of this blog are not ‘working people’ so let’s take your minds off our impending doom by remind you of previous Budget dooms. We will summarise the budgets over the last 20 years and show the changes to the bottom-line for two real investment examples.

Decade 1

Budgets were a minor affair for property investors, you tuned in only if you had a vested interest if beer was going up 2p a pint or not. From 2003-2013 we were left completely alone on the income tax side apart from some very minor fiddling. On the capital side, stamp duty pay rates actually got better for us after the 2008 financial crises with investment properties attracting:

Up to £125,000 Zero

Over £125,000 to £250,000 1%

In addition, properties in designated areas of disadvantage had zero stamp duty up to £150,000. Most northern city centres, the best location for investment at the time, qualified. In the most part investors paid little or no stamp duty for this decade.

Capital Gains Tax (CGT) on the other hand suffered a bit of meddling with the rates below shown for higher rate tax payers:

2003 - Equal to income tax rates but with taper relief down to 24% after 10 years ownership.

2008 - 18% flat-rate

2010 - 28% flat-rate

Holiday lets usually qualify as business assets, the CGT paid was just 10% up to a total profit of £10 million. Nice.

Decade 2

Then, all of a sudden, budgets started to become a must watch event for property investors. Some years you had to hide behind the sofa. On the income side, the most lethal blow was delivered in 2015 when Section 24 to the Finance Act prevented individual investors claiming mortgage interest as a cost against profits for long lets. Whilst this was tapered in from 2016-2020, it immediately dealt a blow to private investors who either began favouring Airbnb-type lets which were left untouched or kept to long lets but did so via limited companies which brought its own complications and costs.

One budget measure many forget was the 10% wear and tear allowance for furnished properties was abolished in 2016. Not many batted an eyelid with this as actual expenses were still allowed. I have been over our portfolio and in reality the 10% allowance was very generous as our average cost is just 3% of gross rent. Another big hit to the bottom line, although more justified than the Section 24 change.

Moving to holiday lets, full capital allowances were allowed which made the income tax-free for much or all of the ownership period and any income that was declared was eligible for pension relief. Over the decade this much more favourable tax treatment meant that Airbnb properties became so much more viable and investors piled in, buying up suitable properties for this purpose or converting their existing BTL stock.

On the capital side, stamp duty got progressively worse for us all. As things stand, the levels are:

3% From £40,001 to £250,000

8%From £250,001 to £925,000

For CGT it was a less dramatic decade and for higher rate payers:

2020 - Holiday let 10% exemption allowed for only the first £1 million gain

2023 - £12,000 annual exemption reduced to £6,000

2024 - Reduced to 24% flat rate and £6,000 annual exemption reduced to £3,000

Just One More Thing….

One of the final acts of the Conservative government was to remove all the favourable tax treatment for holiday lets and make it equal to long term rental income. All the advantages such as mortgage interest being deductible, capital allowances, 10% CGT and income being allowed to attract pension relief all went at a stroke. Oddly, the income for this type of letting still attracts VAT unlike long-term rentals which all tips the balance fully back to long lets as far as tax is concerned.

Non-Budget Differences

Focusing just on the previous decade, we have seen huge moves outside of taxation. Rents according to Homelet have increased 66% on average from £800 to £1331 pcm. Costs have jumped through new regulation (eg EICRs, Selective Licencing) and rocketing maintenance costs and apartment service charges amongst other things.

SO WHAT?

What’s the net affect of all these tax and other changes over the last 10 years?

I dug out our own tax returns and tracked the net monthly income back to 2014, correcting for inflation, for two of the most ‘vanilla’ properties we hold.

Long Term Let

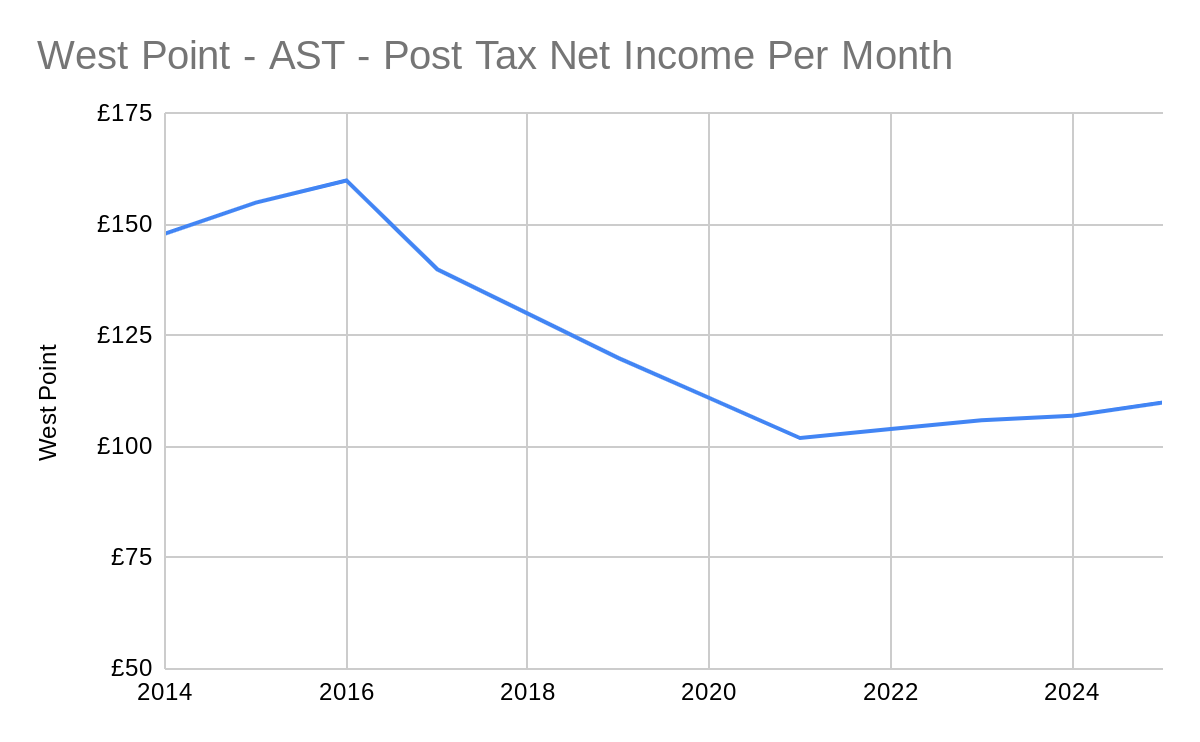

A 2 bed / 2 bath apartment in Leeds City Centre bought in 2013 for £125,000. Rents have flown up from £795 to a current £1450 pcm. But so have mortgage rates, service charges, maintenance etc etc. The net effect in real terms on monthly post tax income is shown below:

Returns have dropped nearly 50% in real terms over the decade, mainly due to Section 24 but also rising mortgage rates post-Truss.

Short Term Let

This is a well-located 3 bed house in York City Centre which attracts a mix of leisure visitors and occasionally professionals working in the area. Gross rental income initially increased to around £6,500 a month but as the supply of holiday lets increased (possibly as investors converted their long lets) it is actually now down to under £5,000 pcm. The forthcoming tax changes to this sector in 2025 then hammer the returns down further and the net real return will be around one third of that in 2014.

Conclusion

Up until 2014, property investors were left alone to get on with their lives and we had good times. But then something changed. Landlords were never the most popular members of society but the Tory government decided we were pariahs and the wider public cheered them on through a series of destructive budgets. New BTL purchases for private investors became nonviable and many left the sector or were squeezed into the holiday let sector. Finally, the viability of many holiday will end with new tax rules to come in 2025. As we have seen from the two examples above, monthly real returns have been crushed for both long and short lets over the last decade.

What’s In The Budget Tomorrow For Property Investors?

Despite the amount of pre-budget leaking, personally I still have no clue about the likely impact. The intended victims seem to be those who are not workers and instead collect their income from assets - they / we are to be hammered. However, from the analysis above in terms of property investment you can see the job has already been done. Unless a full on review of property taxes is announced (an introduction of a Land Value Tax?) I am not sure where we can meaningfully be punished for renting out property.

In terms of capital gains, the OBR have said that the recent drop of CGT from 28% to 24% will actually bring in more revenue. Of course it will be very tempting for Reeves to increase it back to at least 28%, if only for posturing but there does not seem much to go at here (famous last words).

On the income side, there is scant net rental income left for HMRC to go after unless investments are held in cash so I cannot see too many major changes. We can’t discount some ‘pasty tax’ type level of meddling I suppose, a budget that does not hammer landlords will not get voted through.

However I leave you with this to keep you up tonight, a Halloween scare if you will. Rachel Reeves might have been in ‘listening mode’ over the weekend when Landlords and the NRLA were claiming that property investors are actually working people. If this were the case then our rental income would no longer be classed as unearned and therefore attract 8% National Insurance. Let’s hope she was not listening to us after all.

Tin hats on everyone….