A Property Investor Dabbles in Shares

We published the first detailed overview of our own investment portfolio in Nov 24, it is here. The idea was to share details of our portfolio to highlight our biases in terms of what we hold and also as we near retirement share any tips, disasters and general lessons we have learned along the way. We outlined just the details of the portfolio and we then promised a deeper dive into each aspect to reveal what’s been going on ‘under the hood’ to get us to where we are at now.

In the most recent update we focused on property, the main sector we have been in for over 20 years. In this update we will focus on the smaller element of our portfolio held in equities. As newbies, we cannot offer any huge insight to the equity market, there are so many articles on Substack that will help. The aim here is to simply help you as a fellow property investor to think about when and how to diversify in other asset classes and pick up on any lessons we have learned in our early days as we stray off the path of property.

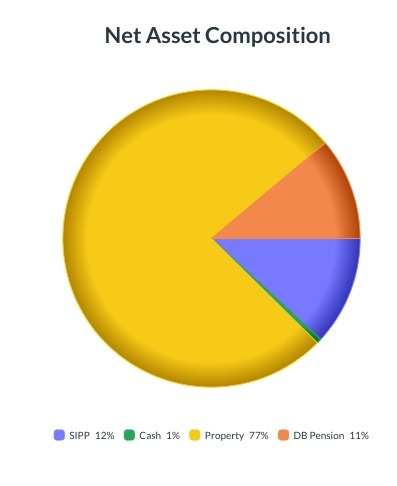

Quickly before we do that, a look at the current overall portfolio composition as we do each quarter:

It is the 12% held within SIPPs which represent our equity holdings that we will discuss in this update. It is a small sector as we have concentrated on property up until 2021 when we began diversifying into equities the closer we get to the retirement goal. Speaking of which, below is our progress towards our target net asset value which will see us through retirement.

A slight adjustment this quarter to the way we value our property holdings has us at 89% towards our final goal. I will detail the way we now value our portfolio in a future post but for now let’s get onto the shares…

Share Portfolio

Our current holdings as at mid-May 2025 are below:

After 4 years of investing, we now have just 4 holdings - roughly half in single stock housebuilders which were bought most recently in 2024 Q3 and the other half in a global index fund. You will note we are currently down in most of our positions, the housebuilders being generally hammered after the Rachel Reeves inaugural budget. So things are not great currently but let’s look now at what we have done so far since 2021 and what lessons can be drawn.

Lesson #1 - Frequency of Trades

The above graph shows activity on our share account over the last 2 years. It includes all transactions so money we put in and also account fees - the actual share purchases or sales average 5 per month and that has been falling over the last year. Frequency of trading is costly - every purchase has a platform fee and every sale attracts stamp duty (0.5%). It slowly dawned on us that this fast activity was costing us and we started to buy and hold for longer periods. We set longer term sales price targets and collect dividend yield along the way (ie like property investing). I would guess we will average 1-2 transactions a month from now and hold for months and years rather than days or weeks. But what length of hold is normal in share ownership? In property it is 5-8 years, give or take. Unsurprisingly, it is shorter for shares and a survey by the New York Stock Exchange showed that private investors hold for an average of 5.5 months.

Looking to the most successful investor of all time, how long does clever Mr Warren Buffett hold his stocks? Famously he said the best hold period was forever, a signal that he buys quality companies and that quality endures. But is that what he really does? One of his most famous trades has been in Apple, detailed here:

https://stockcircle.com/portfolio/warren-buffett/aapl/transactions

Since taking his first big positions in 2016, Warren bought 13 times and sold just 9 times whilst gaining a 400% profit. His confidence to take big positions when the time was right shows his confidence and reduced the costs and mind space needed to make more frequent trades in this stock over the last 8 years. Shall we all just copy Warren?

Lesson #1 - Frequency of Trades

Frequent trading is perhaps inevitable when starting to invest in stocks. Compared to property, it is fast moving and you can do it with a swipe of a screen on an app. In truth for the amateur investor like me, the fascination with getting updates on my phone and taking positions daily was initially little more than like placing bets on Bet 365. In addition, the stamp duty and platform commission really eat into any profit. Far better to copy clever Mr Buffett, go all-in when the time is right, set a sales target and back your winners for longer hold periods to net the maximum gains.

Lesson #2 - Stock Picking Vs Index

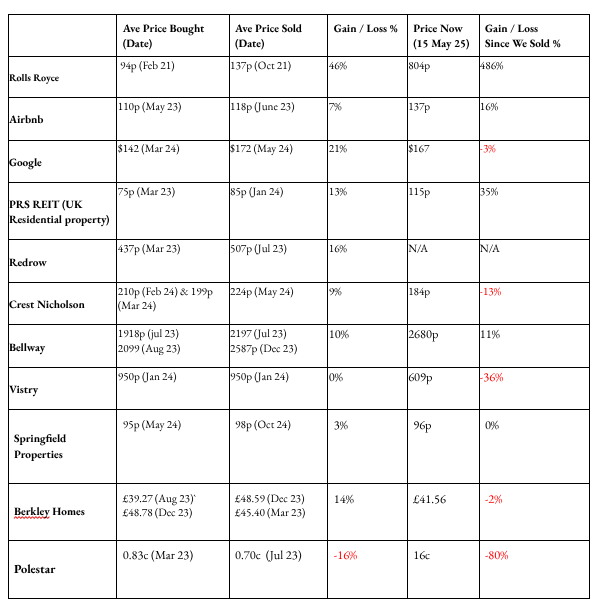

Roughly half of our share portfolio is now in an index fund but over the last 4 years we started mainly playing with the following single shares in sectors we understood or have an interest in:

Allocations to the above were all over the place - some of the positions were clearly risky and so we went small. We went all in on others, Rolls Royce for example was the only stock we held in 2021. This method of stock-picking with an increasing emphasis on indexes has given us an average 16% return pa for the last 4 years. Bench-marking that with the HSBC Global Index fund since 2021 which delivered 9.8% annualised over the same period. So, we have beaten the market but genuinely with more luck than judgement and have made losses recently as well as getting out way too early with stocks like Rolls Royce.

So lesson #2

Stock picking in sectors we understand has delivered greater returns over the index, but it could well have been dumb luck. Index investing has grown to nearly half of the portfolio and to reduce risk this should continue to form the larger part of our investments rather than bets on single stocks. However, if a sector we know well is seen as undervalued then we should consider it. When we do stray from indexes, instead of plumping for just a few single stocks as we have done up to now, a greater mix of stocks in that sector should be considered rather than just betting on single stocks.

Lesson #3 - Shares Vs Property

The real power of this asset class versus property is the total lack of any effort whatsoever. Property investment is an active pursuit, things are always happening and you are the CEO and must fix it or pay people to fix it and check they have fixed it. When investing in shares, there are lots of CEOs all working on your behalf, they get paid to do that of course but in return you have to do nothing. After toiling 20-odd years in the property trenches, that’s a nice thing.

In terms of returns, it is the way each asset class is treated which makes all the difference. Regarding tax, recent governments have treated property investing like cigarettes and smothered us in ‘sin taxes’, hammering our net total returns. However, the government see investing in shares as a virtuous pursuit and offer us tax advantages of ISAs and SIPP to put rocket boosters to returns. This has made a massive difference to us so far - when allowing for 40-45% tax relief on SIPP contributions the 16% pa return becomes approx 28% annualised return on invested capital since 2021. The returns have been 2X the returns we have achieved in leveraged property over the last 4 years, in an asset class we are new to and by doing no work.

A SIPP is not for everyone, an investor in their 20s or 30s may want to get access to their cash sooner for example so an ISA may be better. But for an investor in their 40s or 50s, access to the SIPP is not that far off and worth consideration when allocating funds each year as you diversify away from active property investing into retirement. A SIPP allows a gross contribution up to £60,000 and ISAs allow £20,000 annually. For a couple, your first £160,000 investible funds can get this favourable tax treatment each year. And if you have kids of any age feel benevolent you can top their SIPP up by approx £3000 per year. They might even thank you one day for it.

Wrap Up

Since we have dipped our toe into equity investing in 2021 the market has been fairly kind. Over that time everything has done well, the FTSE is up nearly 30% whilst the mighty S&P 500 has done over 40%. It has been an easy time to enter the market, this purple patch is unlikely to be repeated over the next 4 years. Unlike property which is slow and steady, the equity market feels more like being a tribute in the Hunger Games and you can get punished quickly. Research must be done, tools sharpened.

We have learned some early lessons which we have shared here but I have the feeling that as an investor I’m just standing in the foothills of this topic. Property investing has been fun over the last 20-odd years and whilst I would never say my learning is finished, this asset class throws up fewer and fewer surprises nowadays. Some of the skills learned in property translate to equity investing but there seems so much more to learn and this makes it intriguing and fun. Also as there is no effort whatsoever it is something that we can all do until old age. Just look at clever old Mr Buffett.

I’m a convert as you can tell and expect our portfolio to be around 80% in equity by 2030. Unless of course an unmissable property deal comes along…