Make As Much Money as Possible by Doing as Little as Possible

Exploring the Options For Lazy Investing

Do you have a mission statement for your investment business? Since 2012, the title of this blog entry has been ours. I like it, it’s brash but it captures everything as an investor we get out of bed (or even better stay in bed) to achieve. As a property investor, what sort of mission statement could you have instead, perhaps something as banal as:

“Delivery of quality rental property across the West Midlands”

Well, yes that describes what you do day-to-day. But at best, you are setting out to make slightly less money by working marginally more than you have to. And if you have no statement at all then, frankly, you are just winging it.

Our statement has proven very useful in focusing both our effort and fund allocation. It has forced us to focus, we conduct a monthly rigorous audit of all our holdings and cull the units which deliver sub-par returns or require too much work. In a forthcoming blog in November we will outline our portfolio in full detail and you will see what I mean, buy and hold forever investors we are not. It’s stopped us being lured into buying assets which throw off high rental yields or properties which require extensive refurbishment as in reality you have to work damn hard to get the returns. Finally, the statement does not dictate an asset class, and has forced us to look across all asset types. In doing so I have recently questioned the merit of property investing altogether.

Enough of Mission Statements - Show Me The Money

Looking back over our investment journey, there has been a real shift in the type of assets bought and sold and I suspect you will have or will experience the same. Initially, we focused on higher income property investments with the explicit aim of getting out of the day-job. The focus was just cash-flow at the start. Once escape velocity was reached and we were full-time private investors the emphasis from cash-flow slowly changed with time becoming the more precious commodity.

Assets bought at each end of this spectrum are clearly different, it is HMOs and scrappy yield-pigs at the start and then higher priced, higher quality units at the end. We all know that in terms of overall returns, it is the capital growth where we get paid in this game and the higher quality properties deliver this in spades (and actually make the most money).

For this blog, I am going to assume you have reached escape velocity or actually do not want to leave your day-job or business. The focus will be on the higher quality properties that need little refurbishment if any and how to just be as lazy as possible whilst making the most money. In an ideal world, we should not even have to get out of bed.

Escape Velocity - Time to Get Lazy

Up until recently, I thought we were nailing the mission by immersing ourselves in hands-off, long-term let property investments. We have been doing this for years now and the cash flow and portfolio value were something to occasionally feel quietly smug about. But recently I have realised, beyond the initial building of the portfolio to a size we could leave employment, that any smugness was misplaced and there is a much lazier way of watching the pound notes roll in and to be honest I now feel a bit of an idiot. I am going to share those findings with you now.

Let’s base all our numbers from the start of this current economic cycle in 2010 and compare property investing to the even more lazy asset class of share investing through index funds.

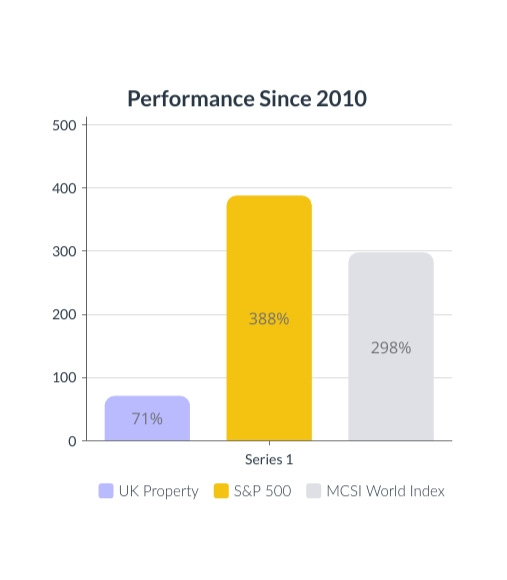

Average growth since 2010 has been:

Oh dear. Honestly, in 2010 if I had the slightest clue the returns would have been anything like the above then I would have stopped buying property there and then. This looks worrying for us property-types, but maybe performance since 2010 has been an aberration?

Let’s go back to 1952 and notionally buy the average UK house which was the bargain price of £1,891. That would be worth just over £265,000 today. Had we put that same £1,891 into the S&P-500 then it would now be worth £3.75 million.

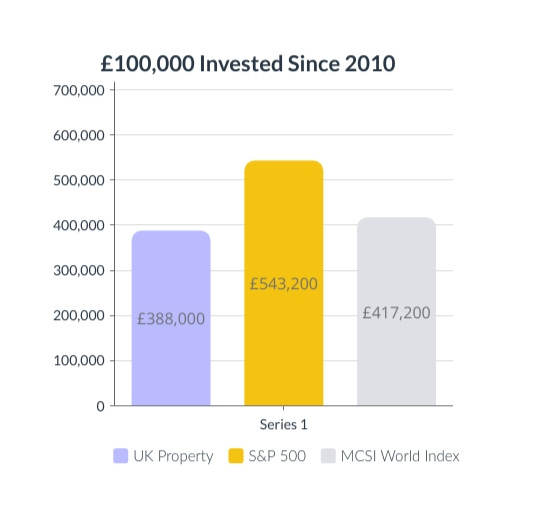

Property is not dead and buried I hear you cry - it has leverage up its sleeve so let’s give property investing the kiss of life with a 75% LTV mortgage. Shares are much more liquid than property but if we level the playing field and trade this liquidity then we are able to invest in shares within a Self-Invested Personal Pension (SIPP) for the tax relief at the front end. This means your money will be tied up until age 55 (soon to be 57) but if you are the average age of a property investor ie 40-45 this is not that much longer than the typical hold period for a property. The background data of each investment are here.

Let’s run the numbers again, property must win this time!

This is a crushing blow if, like me, you have been busy buying properties, dealing with tenants, replacing boilers. You could have just opened a SIPP and with a couple of clicks made your investment and done nothing and made far more money. Property investment results in less money by doing more work.

I am sorry to deliver this news but, for lazy individuals, property investment is dead and buried. Move on. Get another hobby.

Just Before You Get Another Hobby

Can property investing somehow be saved? We could fix up a ‘Homes under the Hammer’ wreck but that breaks the rule of being lazy - that is just like getting another job. No, we need to concentrate on doing as little as possible. So far we have based on our numbers on the UK average property, as wily investors surely we can do better? From some of the mistakes I have made since investing in 1993, here’s some ways I would suggest beating the average:

Do not buy new-build. These almost always under-perform, despite being so very tempting to the very lazy.

Buy the property type which typically grows the most.

Buy in an area which is due to outperform the average growth.

Buy at a good time, hold the property for the optimum time and then sell.

Yes, I know all the points above need a degree of hindsight. But let’s use the list of hindsight above and choose the very best property investment since 2010 down to the exact address. We can then run the numbers and property must then surely beat index funds and this blog still has a purpose.

Property Type

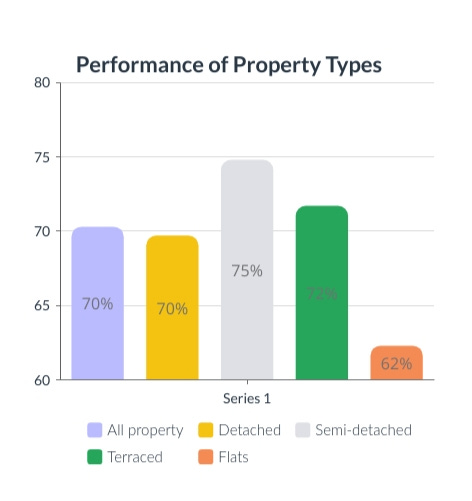

Examining the Land Register for which type of property has performed the best since 2010:

So, we are in the market for a non new-build semi-detached. They have performed the best, since 2010 at least, and offer the ability to add value through extensions etc unlike flats (if you can be bothered).

Location

Next, we use the Land Register again and utilising the rear view mirror to look for the location which performed the best since 2010. Ladies and gents, that is the London Borough of Waltham Forest where the price of a semi has grown 142% since 2010. [A warning for the very lazy, hands-off new builds have only grown in price around 50% since 2010 in Waltham Forest]

And the Winner Is…

And finally, we have the best investment in the UK since 2010 (give or take):

A handsome 4 bed semi, sold in early 2010 for £340,000 and re-sold recently for £1.05M - click here for the listing. The property looks to have benefited from some minor refurbishment over the years, so not exactly doing nothing but not too taxing. Not let’s see if property now wins.

Come On E17 - Let’s Beat the Index Funds

Assuming we bought the above property in Walthamstow in 2010 and put 75% LTV finance (£255,000) on it:

£340,000 property value became £1.05 million by 2022. Pay off the £255,000 mortgage and we are left with £795,000.

Take that MCSI World Index - nearly double the return! And even the mighty S&P-500 has been slain. Property wins hands-down - we have not been wasting our time after all.

The Small Print

Hindsight is a fairly wonderful thing. Identifying a hot-spot like Walthamstow in 2010 is just akin to stock-picking and choosing to load up on Nvidia shares 5 years ago. We could never have known with certainty that Walthamstow would be the winner in the UK, just as it was impossible to predict the fortunes of a single stock like Nvidia. But it does show that property investing, even when done in a very hands-off fashion, can outperform the pesky Index funds - we still win.

Where Have the Winners Been Since 2010?

To match the gains of the S&P 500 within a SIPP, property (using 75% LTV finance) would have needed to increase by at least 90% since 2010. We can use the (excellent) Bricks & Mortar tools to just see exactly where that occurred, in England & Wales:

The red-ish dots on the map show all the areas where property has beaten the indexes.

So, hardly anywhere then.

It turns out to be very rare for property investing to beat the index funds, just London, Bristol and Manchester managed it in this cycle. If have been investing here this cycle - well done you. Outside of these 3 cities, only Nottingham and Leicester came close to matching a boring old SIPP. Nowhere in the North East, Wales, South East or East of England came close. In fact, from my own research none of Scotland made the grade either. This is a bit awkward.

Even then, it is patchy within the cities. Manchester is a perfect doughnut for example:

In Bristol, there is a similar plot with the suburbs (dominated by houses) doing better:

Clearly, the large amount of apartments in the centres have under-performed and even if you had picked the right city you would have still failed to beat the index funds if you had plumped for a central apartment.

To some extent, it is a similar story in London with the outer zones which were better priced in 2010 which beat the index funds:

We are therefore left with, at best, 10% of the country by population that has proven viable for hands-off investment this cycle when compared to index funding via a SIPP.

Finally, perhaps you do not want to invest inside the tax-advantaged SIPP. You may have reached your annual contribution allowance of £60,000 but have more funds to invest. Or you may wish to get your hands on the funds before age 55. The parts of the country which would have matched or bettered index funding outside the tax-advantages of a SIPP are:

So, a little bit more of the country then.

Conclusion - How to Make the Most Money by Doing as Little as Possible?

The start of every property investor’s journey should be to get into a job they find interesting and rewarding and one that will throw off sufficient funds for regular investments to be made. For some, they are already doing a job or have a business they love. Others, like us, may initially use high-income property such as horrible yield-pigs or HMOs to escape the day job and no shame in doing that.

Once that’s done, to get the most money by doing as little as possible it’s actually index investing that wins especially for your first £60,000 of investible funds per year through a SIPP. UK property as an investment can only get close when 75% LTV lending is used to juice the returns. To beat the top like the S&P or Global indexes, investing in a passive and lazy manner, you have to be operating in the top decile of property locations when compared to a SIPP. You will need to be really lucky or skilful in selecting a location that is going to outperform the market and hold it for the optimum time before selling. Also, whilst the power of the index funds is in their diversification, with property investing this can be your greatest enemy. Buying a diverse portfolio across the UK will not only be tricky to manage but will ensure you do not beat the index. To be lazy and successful in property, it is the skill of selecting the best areas at the right time and going all-in which sets you apart. This is the skill which lazy property investors need to develop. Our Buy, Sell or Hold Model updated each quarter is designed to help you sharpen your tools.

But any type of property investing, even prime single lets, will always be harder work than pressing a button to buy an index fund. Index fund investing, via a boring old SIPP if you can wait for the pay day at age 55, is for most of the lazy investors the weapon of choice.

I know this blog will be challenging for many readers, you may disagree with some or all of it. If so, you want more than the boring indexes. You don’t want to accept just the standard property returns. You will be out there hunting down the best areas which are nailed-on to outperform and buying property types like the example in Walthamstow in 2010 which will then magnify the gains.

You dear reader are different, you believe you can beat the market through property and I am with you! That’s the aim of this Substack, to share ideas and suggest the rare areas and individual assets which require minimal effort but deliver these superior returns. Or to put it another way - make the most money by doing as little as possible. That’s all this Substack is here to discuss. Thank you for joining me on this ignoble quest.

Next Month - The End of Q3 Buy, Sell or Hold Update

Footnote - for those left fuming that net rental income or share dividends were not included in the calculation. In reality, when 75% LTV finance for property is used, taxes, letting agent and maintenance etc then the difference will be marginal and offset by the increased costs of property transactions (stamp duty, legals will take years to burn off) and the time that running a BTL portfolio will entail.

Footnote 2 - for those of you left even more fuming than we did not model re-financing property, apologies we did this to make the blog simple. Sure, if your initial investment had performed well then you could pull out enough money after say 5-7 years to fund the deposit for another BTL. With luck, you might even be able to then match or even better the returns of an Index within a SIPP after another 5-7 years. This is quite possible, but do not forget the additional costs and risk of gearing up in a market which has already performed well for a while and could experience falls which could push your now thin equity. Oh, and you now have 2 properties to run and all the faff with that. It’s an option, just not a lazy one.