Recent political and economic shifts really have been seismic, as an investor you could be left battered, bruised and seriously considering your chosen strategy. I know I do. On top of this, as UK property investors we are a particularly unloved part of society and have been hit by every possible tax hike and regulation. It is only natural to question if the venture is worthwhile at all. I want to use a quick history lesson in this blog to uncover the strategies which are more likely to be successful in the coming decade for property investors.

At times like these it is useful to remember that things are ever-changing in the property and investment landscape, currently we are just going through another period of such change. These periods of change in property investment have been equally dramatic in the past in the UK, perhaps more so, let’s take a whistle stop tour of the UK Private Rental Sector (PRS).

The change in the PRS over the last 100 years is incredible, the graph above shows its fortunes over the last century. Regardless of your property investment strategy, the size of the Private Rented Sector (PRS) has a massive impact on what you do and how successful you will be. There remains one constant in the PRS, it is never stable and the size of the sector swings massively due mainly to government intervention. To give us the best chance of success, we need to think about the likely future government policy and resultant size of the PRS.

Let’s take a quick look over the last century of the PRS, we will see some clues how to invest for the future.

A Quick Look at the Private Rental Sector Over the Last Century

Before 1920, 90% of housing was PRS with large developers and landlords financed by building societies dominating. Standards were ‘mixed’ with slum areas in city centres very common but also decent accommodation linked to employees of a nearby large factories. Employers that made chocolate were oddly keen on housing their workers near their work, George Cadbury and Joseph Rowntree famously built high quality family accommodation in Birmingham and York.

Property Investors back then typically had huge portfolios, this was not a ‘mom & pop’ business. So imagine the turbulence these investors went through, over the 2 world wars and then in the economically challenging post-war period as the PRS sector drew down gradually to near-zero. Some highlights were:

1918 - David Lloyd George promises “To make Britain fit for Heroes to live in”. By 1939, 3.5m new homes are built and the PRS drops to 58%.

1946 - Labour’s New Towns Act. In 5 years, 1.5m (mainly pre-fab) houses are built. The same target of today’s Labour party….

1951 - Tory’s go one further and build 2.5m and are responsible for Hemel Hempstead, Harlow, Crawley and Milton Keynes.

1960s - The short love affair with concrete slab high-rise gets going. By the end of the decade home ownership is up to 50%. House prices become a thing at dinner parties and double between 1970-1973. The PRS is almost eradicated and reduced to just 7% of the total housing by 1980. Boom & bust is with us forever.

1980s - Council tenants are offered up to 70% discount to buy their home. Unsurprisingly, half of them take it up. The social housing sector is destroyed and the Assured Short Tenancy arrives and gives birth to Buy-to-Let.

2000s - Blair. Peak home ownership in 2001 - it hits 71%. Net migration ramps up, as does the PRS.

2010s - Near-zero interest rates prevent house prices falling further after the GFC. High prices and high net immigration push the PRS to maximise space through HMOs. PRS peaks in 2016 at 20%.

2020s - Response to CV-19 and subsequent rapid-rise in interest rates puts pressure on prices and rents. The PRS begins to decline as Landlords are discouraged by government policy and taxation.

That’s the history lesson, now let’s look at the recent changes in the PRS.

The Recent PRS in Detail

Charting the PRS growth since the inception of the Assured Short Tenancy, we can see from the above chart the red PRS chunks in the bars starting to contribute more and more to the net supply each year. Just look at the incredible contribution PRS made from 2002 until 2015, often in years when owner-occupier rates decreased. This was the boom time for Buy to Let, not involving big investors like back in the early 1900s but now a fragmented brigade fuelled by cheap mortgages who typically own 1 or 2 units. However, since 2015 BTL is becoming a minority sport with Hamptons recently predicting the sector will drop to 8% of the sector - back to the levels last seen in 1990.

Since this peak in 2015, various budgets (detailed here) have started to reduce the viability of the “mom and pop” BTL landlord and sales have outpaced purchases for the last decade. So how is it that the PRS has only shrunk by a small amount so far? We have the arrival of the Built to Rent (BTR) sector to thank for that:

In a reversal back to the large-scale landlords of the 1900s, the BTR sector is quickly growing. Currently only around 100,000 BTR units have been completed but this is due to more than triple by the early 2030s with a growing proportion of BTR houses (single-family homes) which have been a true rarity in the UK up until now.

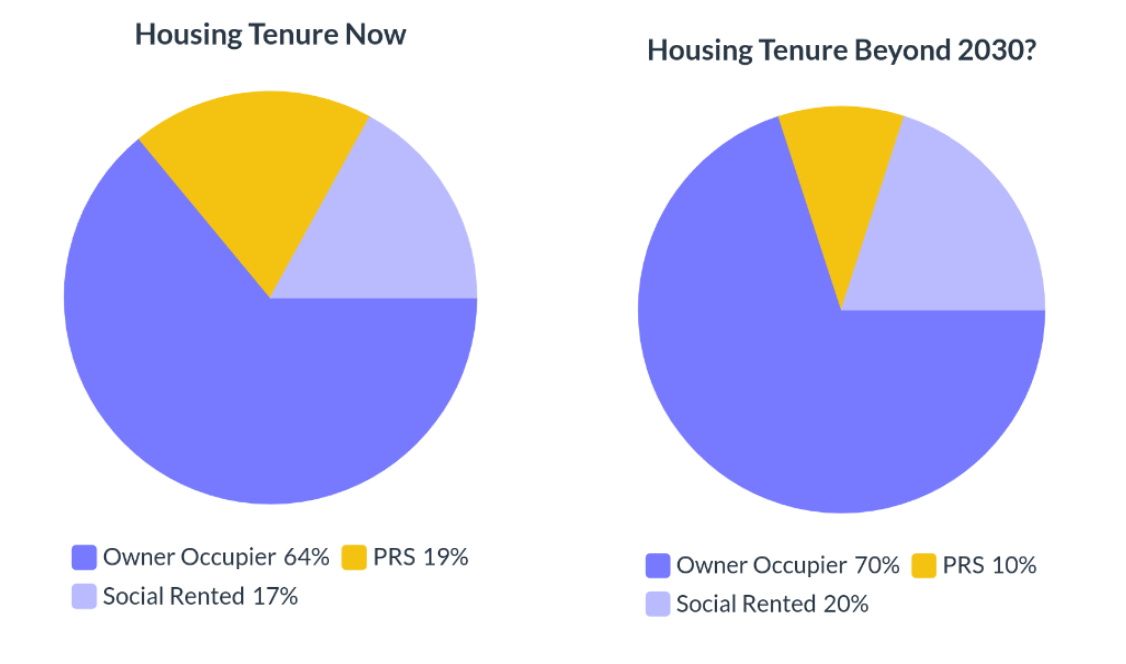

Taking a guess at what the housing mix will look like in the medium term will help guide your investment decisions. It is a guess, but we can see that recent government policy act in the following ways:

The PRS, particularly small-time landlords, are being encouraged away from the sector and net sales are likely to dwarf net purchases.

The 1.5m building target is likely to fall short and one lever that the government will try and pull is the building of social rented property to make up the gap.

PM Keir Starmer has a stated aim of owner-occupation of 70%.

Therefore, tenure is likely to be split as follows:

So What?

That very brief history of the PRS tells us one thing - to succeed we must focus on government interventions and do not go against the grain and work with the direction of travel. What is that direction?

Labour Housing Policy

Freedom to Buy scheme - permanent mortgage guarantee scheme for FTBs.

‘First Dibs’ for local buyers of new developments.

Pledge to increase home ownership back above 70% of all tenures.

1.5 million new properties in 5 years

Taxation Policy

Section 24 reduces net income for private landlords and encourages investment through corporate structures.

Abolition of the Furnished Holiday Let (FHL) tax class will do for Airbnb-type accommodation what Section 24 did for Buy to Let. However, the effect is much greater as the treatment of capital not just income was much more favourable for FHLs with capital gains taxed at just 10%, capital allowances and profits being eligible for contributions towards a pension and therefore pension tax relief. With this all gone, the sector has taken a near-fatal kicking.

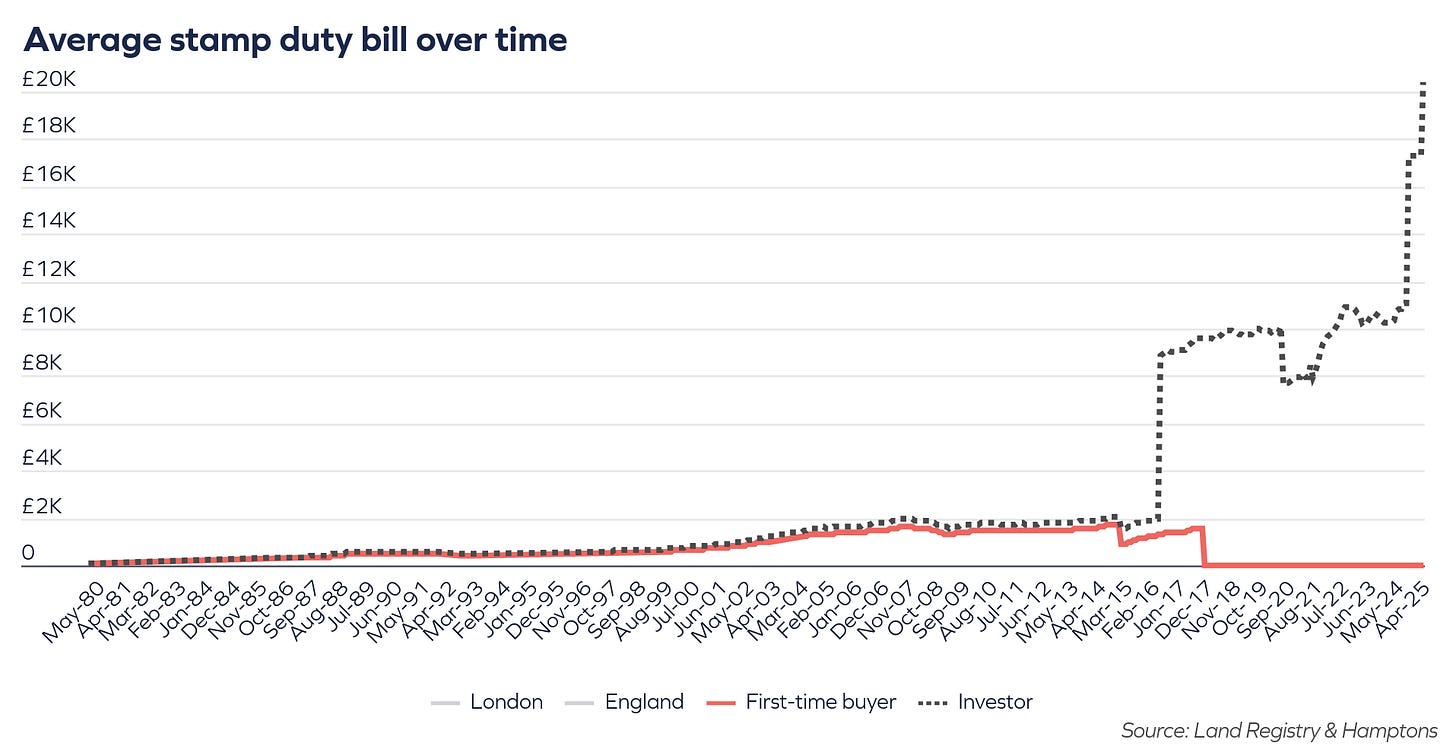

Stamp Duty. Looking at the graph below really does describe what Angela Rayner means by FTBs getting ‘first dibs’ on property.

The rates paid by investors and FTBs were largely the same until 2016 when around £2,000 was paid in stamp. First the Tories and more recently the Labour party hiked the pain on investors who now will pay on average £20,000 just for what used to be literally a stamp on a bit of paper. Comparing buyers for the same property, first for a typical BTL and then for a larger Airbnb type of property:

The disparity is astounding, we should have got the message in 2016 when stamp duty was hiked but like the slowly boiled frog many investors did not notice. Now the water is boiling, all the frogs still alive should take note.

Look at the £300k example above, an FTB pays nothing in stamp duty, the BTL investor pays £20,000. That £20,000 has to come out of the pocket, not mortgage finance. If it could have been used instead for the deposit when financed, that £20,000 would have been leveraged to an additional £80,000 in buying power. Or look at it another way. That investment is likely to throw off say £300 per month in net rent, all being well. That means for the first 6 years of the investment, you are not even breaking even on the stamp duty let alone the other purchase costs of legals and mortgage arrangement. Or think of it another way, it is like walking up to the bar in a pub. The guy in front of you is charged £4 for their pint of Guinness. Happy days you say to yourself, seems cheap. But then you are charged £6 for the exact same pint whilst the barman calls you a money-grabbing rentier. Would you call this bar your local? Thought not.

The Future Landscape

What’s in store for the PRS and what role will private investors have in it?

Here’s my thoughts:

Property Investment needs to be in investment grade units ie not units focused at owner-occupiers especially FTBs.

There is a return of social housing building, in a rush to meet the 1.5 million new homes target.

BTR slowly changes the make up of PRS.

If Only There Was a Way to Put This Into a Picture

In terms of the future landscape for private investors, the obvious way to illustrate it seems to be a precariously-balanced multi-scoop ice cream cone. I know, obvious. Think of each scoop as a distinct property type. The higher up the scoop is, the more likely it is to fall off the cone and be unsuitable for us as investors in the future. So, running with our ice cream model we have:

In the past, investment into apartments and single family houses has been easy and the go-to route for most. Taxation policy has ended our fun, this ‘scoop’ is the most likely to fall from the top of the stack, closely followed by the light refurbishment ‘scoop’. Taxation now massively favours owner-occupiers for these scoops, especially FTBs. Unless they have an angle such as the unit being cash only or blighted for some reason that will hold homebuyers off then we really should leave these ‘scoops’ alone now.

As we move down the stack we come to heavy refurbishments (think Homes Under The Hammer) and HMOs. Here we may come toe-toe to with owner occupiers still. The owner occupiers will be few and far between in terms of competition but they will exist. For example, HMOs can often be turned back (with some effort) to a family home if in an up-and-coming area. As investors, this should be an area where we can work, targeting projects that will just be too ambitious for most home-buyers. Conversely, for brave home-buyers with their lower entry fee of reduced or no stamp duty, they will do well here. [My sons are soon of the age to be FTBs - I will recommend they go for these lower scoops. Of course they won’t listen to dad…].

Below this, we have 4 scoops that are just for investors and are more commercial in nature. These scoops also have the advantage of commercial stamp duty which is much more favourable. Working in this area requires far more skill and professionalism, but the rewards will be huge. Picking up an unloved commercial unit that is suitable and attractive for residential use really sticks out as going with the grain of government policy for example. As the current cycle plays out, if you have the skills, there seems no better way to play. Targeting the design and finish towards FTBs who are likely to get incentives in future budgets would be key, even if you initially rent the units.

I personally lack the skills for anything below the top 2 scoops of the ice cream. Time’s up for this cycle for new acquisitions in any scale. However, at the bottom of the next crash (whenever that comes) I would be very happy to be in funds and buy a distressed residential block off say a Built-to-Rent owner who ‘got over their skiis’ at the appropriate discount. It would be a simple matter of operating it for a short while and then offering first dibs to a stream of FTBs who would appreciate this usually high-end offer. Until then, it’s just a case of licking the ice cream and waiting. Enjoy the scoop that suits you….